Virtual CFO Services

Say goodbye to endless financial paperwork and say hello to streamlined operations. With our Virtual CFO Services, you’ll have real-time updates on your company’s financial health, without the need for an in-house finance department that takes up office space and drains HR budgets.

Let us take care of the numbers while you concentrate on your core functions. It’s the perfect solution for busy professionals like you who want to maximize productivity and minimize stress.

Ideal for MSME's with turnover between ₹5 Crores to ₹500 Crores

Why Choose Our Virtual CFO Services

Expertise and Experience

Leverage our experienced financial professionals with industry expertise to create customized strategies aligned with your business goals.Cost-effective Solution

Cost-effective executive level financial guidance to save on expenses while accessing top-notch expertise for efficient resource allocation.Strategic Financial Planning

Strategic financial plans with your long-term goals so you can benefit from market analysis and growth opportunities identification to make informed decisions and drive business success.Scalability and Flexibility

Our Virtual CFO services adapt to your business growth and changing needs. We offer flexibility for expanding into new markets, raising capital and navigating mergers and acquisitions.What We Offer

Cash Flow Management

Truly digitized and virtual accounting with the use of reliable tools like Tally, Zoho and more

Automation Plan

Long-sighted approach on reducing manual interventions in daily and regular activities

Budget Preparation and Review

Personalized assistance for all key decisions and reviews

CFO Growth Calls

Brainstorming and helping you move closer to your growth goals

Periodic Review Meetings

Driving action and holding internal and external stakeholders accountable for action

Top & Bottom Line Improvement

Gross sales and net income growth in tandem

Year-round Support

Support on filings, audits and financial health checks

Budgetary Control Mechanisms

Close an eye on expenses and money management to ensure you never run dry of liquidity

Investor Relationship and Reporting

Get reliable and timely reports. The results? Seamless IR practices

Legal Compliance

Meticulous supervision and action on all compliance necessities

Accounting Policies Procedures

Complete control and care of compliance and internal policies

Our clients trust us with their company's financial interests

How It Works?

Initial Consultation and Assessment

We analyse your business needs, goals, and financial challenges, creating a customised financial strategy aligned with your objectives

Step 1

Ongoing Financial Monitoring and Analysis

We continuously monitor your financial performance, provide regular analysis, and recommend adjustments as needed

Step 2

Regular Reporting and Strategic Recommendations

You will receive comprehensive reports, including financial insights, and strategic recommendations to optimise your financial strategy

Step 3

Collaborative Communication Channels

Our Virtual CFO team stays connected to you via meetings, emails, and calls for effective communication, addressing your questions and concerns promptly

Step 4

Transform Your Business with Our Virtual CFO Services

Supercharge your financial success with our expert Virtual CFO services. Unlock strategic financial guidance, optimized profitability, and growth opportunities. Schedule a consultation today!

Get In Touch

FAQ's

A virtual CFO (Chief Financial Officer), is an outsourced professional who provides financial management services remotely. They offer expertise in financial planning, analysis, reporting and strategic decision-making, similar to an in-house CFO.

We provide financial planning, budgeting, cash flow management, financial analysis and reporting, profitability analysis, financial modeling, strategic planning, risk management and financial decision advice as virtual CFOs. We work closely with individuals and businesses to assist them in efficiently managing their finances. Our responsibilities include generating complete financial plans, realistic budgets, monitoring and projecting cash flow, analyzing financial statements, evaluating profitability, developing financial models, devising strategic plans and executing risk management techniques. We help our clients make informed financial decisions and achieve their goals by offering these services.

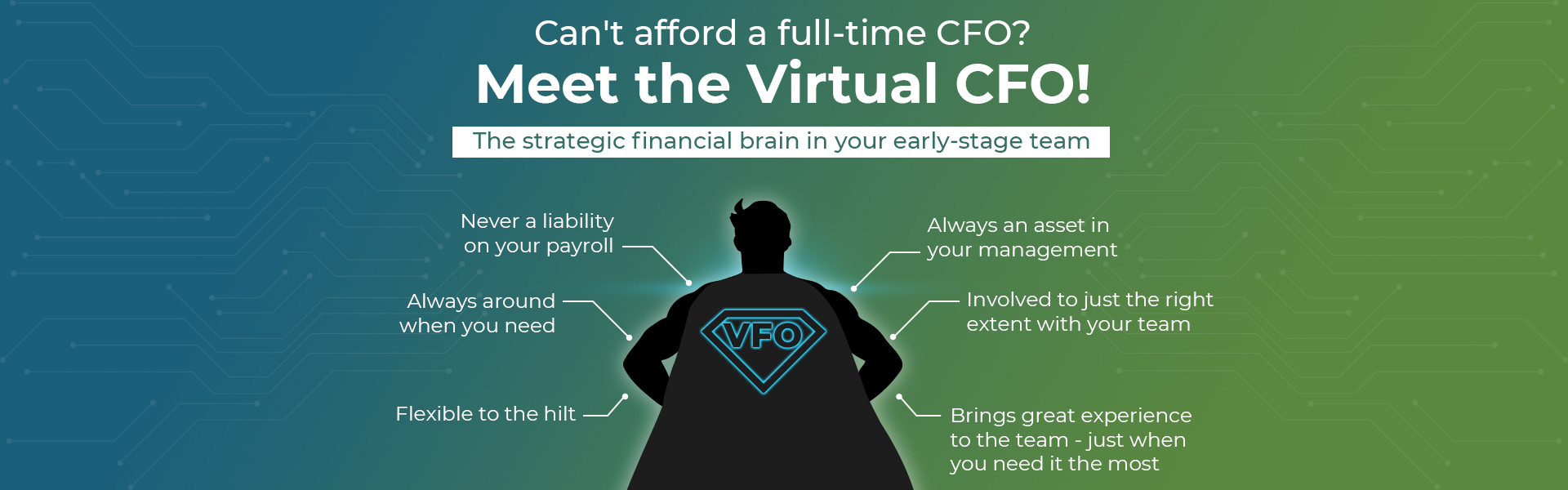

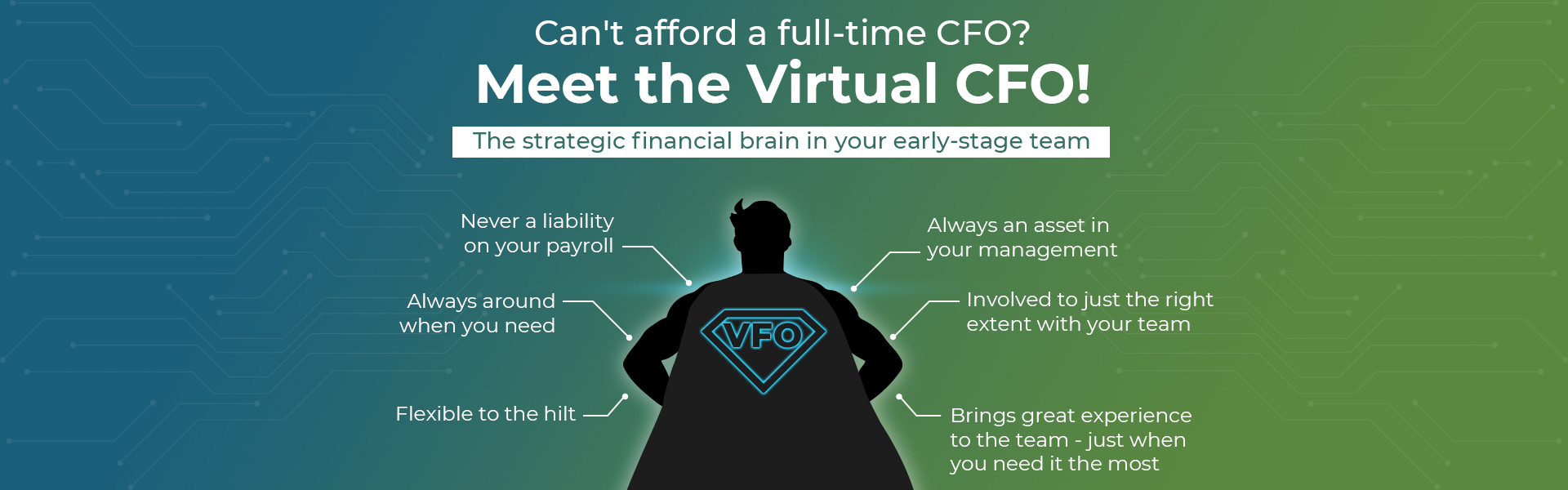

A standard CFO works full-time for a firm, whereas a virtual CFO works remotely on a part-time or project basis. Virtual CFOs work with numerous clients at the same time, providing financial expertise at a lower cost than a full-time in-house CFO.

Hiring a virtual CFO provides several advantages, including access to high-level financial expertise without incurring the expense of a full-time CFO, scalability as the business grows or faces financial challenges, unbiased financial advice, improved financial decision-making and more time for business owners to focus on core operations.

Virtual CFOs operate remotely using technology and communication technologies. They can use cloud-based accounting solutions to securely access financial data, communicate with clients via video chats, emails or phone calls and collaborate on financial reports and analyses via shared documents and online platforms.

Yes, virtual CFOs can tailor their services to your company’s exact requirements. They may customize their knowledge and assistance to match your financial concerns, industry-specific requirements, growth ambitions and overall business goals.

Yes, our Virtual CFOs offer specialized expertise along with seamless technology integration. They also provide flexibility as well as cost-effectiveness.

Absolutely! Our Virtual CFOs are particularly beneficial for small businesses and startups as they provide affordable access to financial expertise without the need for a full-time CFO.

Our Virtual CFOs collaborate remotely, utilizing cloud-based accounting systems and interact with your team to provide real-time financial insights.

Yes, our Virtual CFOs place a high value on data security and confidentiality. They use secure systems, follow privacy standards and adhere to industry best practices.

The frequency of interaction can differ, based on your business needs. You can expect regular communication, including scheduled meetings and updates as required.

Our Virtual CFOs can analyze your finances, identify cost-saving opportunities and implement strategies to improve financial efficiency.

Yes, our Virtual CFOs provide guidance on regulatory compliance and assist with tax planning and filings.

Certainly, our Virtual CFOs can assist with fundraising efforts, creating financial projections and offering financial insights to help secure investments.

Virtual CFO services are more cost-effective compared to hiring an in-house team. The costs may vary based on your business size, and specific requirements.

Just fill in some details here and relax until we reach out to you. Then, we’ll discuss your specific needs and requirements and Voila! You’ll have your own Virtual CFO.