Get In Touch

Accurate Business Tax Filing By Experienced Tax Auditors

What Is Tax Audit?

A Tax Audit is a thorough examination of a company’s financial records and transactions to ensure that the reported income, expenses, and claims are accurate and compliant with tax laws. A company tax audit is more than just a regulatory requirement. It is conducted by an experienced auditor and tax consultant, and it provides an opportunity to assess financial health, identify potential risks, and explore growth opportunities. GGC’s Tax Audit services go beyond basic compliance checks. Our experienced Chartered Accountant for tax filing meticulously reviews your accounts, ensuring that every detail is accurate and aligned with the Income Tax Act of 1961.

Who Needs Tax Audit Services?

Tax Audits are mandatory under Income Tax Audit Section 44AB for businesses with turnover above ₹1 crore, including LLPs, partnership firms, and professionals. These audits are crucial for ensuring that all financial records are accurate and compliant with tax regulations. For MSMEs, meeting these requirements is vital to avoid penalties and ensure smooth business operations.

Eligibility For Auditing & Taxation

1. Turnover exceeding ₹1 crore in the previous financial. year

2. The audit must be conducted by a qualified Chartered Accountant.

3. Businesses opting for the presumptive taxation scheme under section 44AD and declaring profits less than 8% of turnover.

2. The audit must be conducted by a qualified Chartered Accountant.

3. Businesses opting for the presumptive taxation scheme under section 44AD and declaring profits less than 8% of turnover.

What is The Procedure For Business Tax Filing

1. Initial Consultation: This is conducted to understand the business structure and financial landscape and provide insights into business tax filing requirements.

2. Documentation Review: Our tax consultants conduct a detailed examination of financial statements and supporting documents and ensure all records comply with the 44AB tax audit.

3. Fieldwork: This part includes our expert CA auditors verifying accounts, ledgers, and financial statements.

4. Report Preparation: A chartered accountant for tax filing prepares an audit report. The report includes strategic recommendations for financial improvements and compliance.

5. Filing: Submission of the final audit report to the tax authorities with a CA audit firm’s timestamp.

2. Documentation Review: Our tax consultants conduct a detailed examination of financial statements and supporting documents and ensure all records comply with the 44AB tax audit.

3. Fieldwork: This part includes our expert CA auditors verifying accounts, ledgers, and financial statements.

4. Report Preparation: A chartered accountant for tax filing prepares an audit report. The report includes strategic recommendations for financial improvements and compliance.

5. Filing: Submission of the final audit report to the tax authorities with a CA audit firm’s timestamp.

List of Documents Needed By CA Audit Firm

To conduct a thorough 44AB Tax Audit, the following documents are typically required:

- Cash Book: This should include records of all cash receipts and payments maintained daily, and it should reflect the cash balance on hand at the end of a specified period, which should not exceed one month.

- Journal Book: This is required if the accounts are maintained using the mercantile system of accounting.

- Ledger: This book should record all debits and credits.

- Carbon Copies: Maintain carbon copies of bills (whether machine-numbered or serially numbered) and counterfoils of receipts issued by the individual for amounts of ₹25,000 or more.

- Original Bills and Receipts: Keep original bills and receipts for expenses incurred. If bills or receipts are not issued and the expenditure does not exceed ₹50, maintain signed payment vouchers instead.

Benefits of Tax Preparation Services from GGC

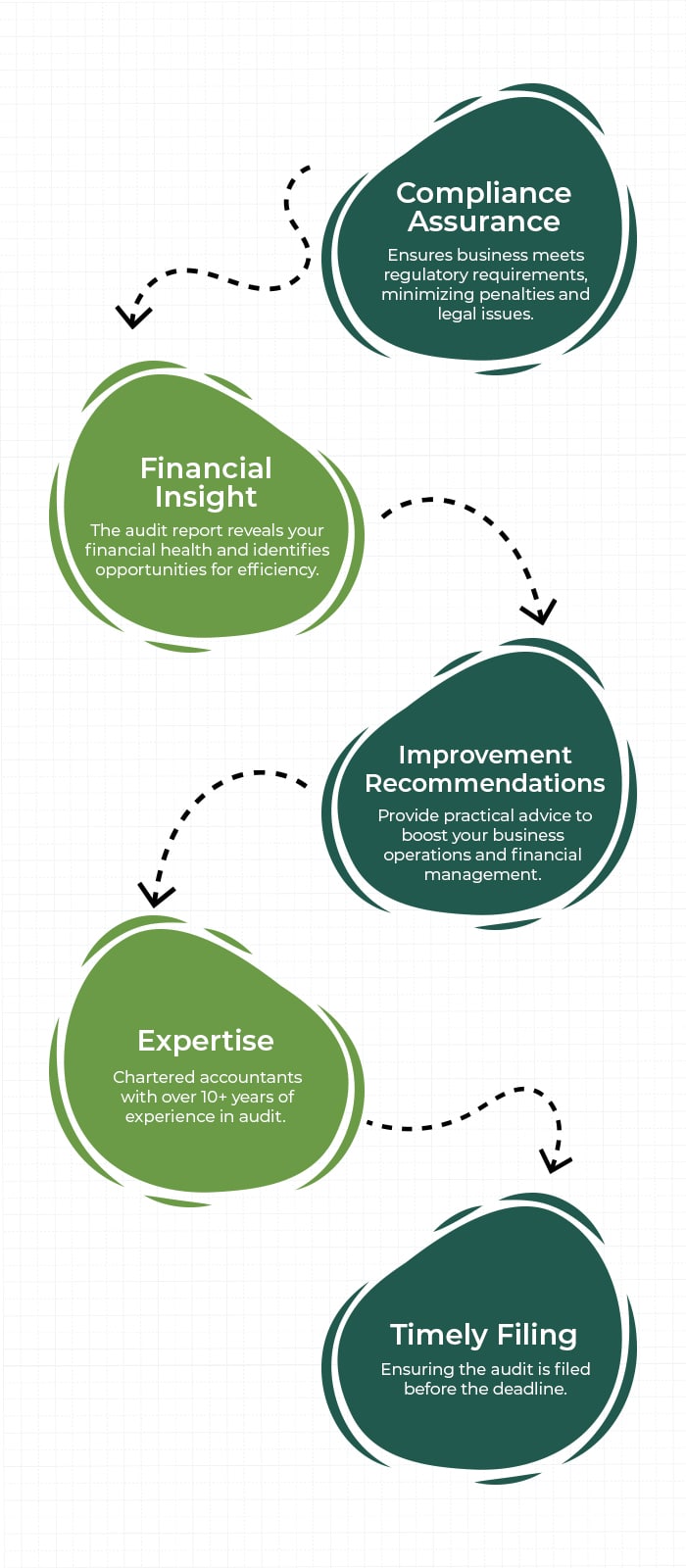

- Compliance Assurance: Ensures business meets regulatory requirements, minimizing penalties and legal issues.

- Financial Insight: The audit report reveals your financial health and identifies opportunities for efficiency.

- Improvement Recommendations: Provide practical advice to boost your business operations and financial management.

- Expertise: Chartered accountants with over 10+ years of experience in audit.

- Timely Filing: Ensuring the audit is filed before the deadline.

Deadline For Tax Audit Under Section 44AB

The Tax Audit under Section 44AB for FY 23-24 is conducted in May and June, with the final filing deadline on September 30th. This timeline applies to all eligible entities, including LLPs, partnership firms, and professionals. Early planning with GGC ensures compliance and avoids last-minute penalties.

Penalties and Consequences For Late Tax Audit Report Filing

Missing the deadline for tax audit can result in significant penalties and consequences:

- Financial Penalty: A penalty of 0.5% of the turnover or gross receipts, capped at ₹1.5 lakh, can be imposed.

- Interest on Late Payments: If taxes are underpaid due to non-compliance, interest on the outstanding amount may also accrue.

- Loss of Credibility: Late filing can lead to increased scrutiny by tax authorities, which can impact your business’s reputation and credibility.

Get In Touch

FAQ's

If your business’s turnover exceeds ₹1 crore in the previous financial year, you are required by law to undergo a Tax Audit. Additionally, businesses under the presumptive taxation scheme with profits below 8% of turnover may also need a Tax Audit.

It’s crucial for MSMEs to ensure compliance, avoid penalties, and gain insights into financial management.

Key documents include financial statements, bank statements, sales and purchase invoices, expense records, GST returns, and previous audit reports. A detailed list is provided in the section above.

The audit typically depends on the complexity of your financial records and the promptness of document submission.

Missing the deadline can result in penalties of up to 0.5% of turnover, capped at ₹1.5 lakh, along with increased scrutiny from tax authorities.

GGC offers expert, comprehensive Tax Audit services, ensuring compliance, detailed financial analysis, and actionable insights to improve your business operations.

Yes, beyond compliance, a Tax Audit can uncover inefficiencies, identify risks, and offer recommendations to optimize your business’s financial performance.

No, Tax Audits are an annual requirement for businesses meeting the turnover threshold. It’s essential to undergo the audit each year to ensure ongoing compliance.

A CA conducts the audit, verifies the accuracy of your financial records, and provides a certified report with a timestamp, which is mandatory for Filing with the tax authorities.

If you’re unsure about your eligibility or the need for a Tax Audit, contact GGC. We can assess your situation and provide guidance on the next steps.

In some cases, if the delay is due to circumstances beyond your control, you may appeal for a waiver of penalties. However, this is not guaranteed, so it’s best to file on time to avoid any complications.

Yes, GGC offers a comprehensive suite of tax services, including tax preparation, filing, and auditing. By choosing GGC, you can streamline your tax processes and ensure consistency and accuracy across all aspects of your financial management.

Our Auditing Experts

CA Sumit Tajpuriya

Co Founder & Mentor

Ritika Agarwal

Co Founder & Faculty

CA Laabhesh Savadia

Content Creator

We have great achivements to show!

0+

Satisfied Customers

0+

Consultants

0

Finance Helps

Our clients trust us with their company's financial interests

Imagine only having to worry about your core function and never having to bother about financial paperwork.